Take a course!

- quickly reduce anxiety & begin to feel more confident with money

- implement simple systems, saving time & money with easy to follow money tips

- start paying off debt, build emergency savings & security

How to save money is a question that I am asked over and over again. There is so much information out there that it can be really difficult to know where to start.

How to save money is a question that I am asked over and over again. There is so much information out there that it can be really difficult to know where to start.

I have come up with 5 simple steps to take that will get you well on the way to saving money each and every month.

How to save money and money management might sound like a difficult concept, but with the right tools and a little bit of time invested initially, it can be really simple to keep track of your spending.

How to save money

1 Make a personal budget plan

This may already be striking fear into you!

Budgets sound scary.

They sound horrible.

And they sound difficult.

It might be easier if you think of it as a spending plan rather than a personal budget. It is simply a plan written down of what you WANT to spend your money on each month.

Just taking the time to write this down can really help you to get your money matters in order. It will also help you to work out how to save money each month.

Which method suits you best?

You might find that using a spreadsheet could help you to record the information in a clear and detailed way.

Have a look at the spreadsheet to see if it would be useful for you.

Sitting down with a pen and paper may be the best way for others – it can feel very satisfying to have the numbers written down in black and white!

If you are tech savvy and love working with your phone then another option is to try some of the apps that are out there.

Don't forget

The most important thing is that you take the time to add up all your income and expenses and get these recorded somewhere.

Don’t forget to add up one-off expenses such as Christmas and birthdays – how much will these cost you on a yearly basis? Then divide that figure by 12 to give you a monthly amount for your spending plan.

2 Am I getting value for money?

There are many things that we pay regularly, yet rarely stop to question these expenses.

Go through each expense and ask yourself if you are getting good value for it. Take for example that gym membership that you took out in January and promised yourself that you would go 3 times a week, every week – work out how much this is costing you per visit. Is it worth it? If yes, then that is brilliant – you are keeping fit as well as spending your money wisely!

However, if you have been making every excuse under the sun to avoid the gym for the past month, you need to look at it carefully. Are you throwing money away? Would you get better value elsewhere? Could you enlist a friend to go to the gym with you, so that you are more motivated to go? Could you save money on this?

If there are any areas where you feel that you are not currently getting good value for money, and are not likely to anytime soon, set aside a time to cancel these payments TODAY.

3 It's only a couple of pounds!

How many times have you said that in the past month?

It is really surprising how quickly these “couple of pounds” add up! Think of that coffee that you buy on the way to work every morning. Or what about the visit to the deli at lunchtime? That extra bottle of wine you throw in the shopping trolley (I know, you deserve a treat after a hard week/day at work!)

Use this calculator to see just how much these small spends are costing you on a weekly or monthly basis.

4 How to save money on insurance cover

If you leave it till the last minute to renew your insurance, it can often get forgotten about and we end up auto-renewing because it is easier.

This is a big mistake. This will definitely not save money!

Always compare insurance quotes, ideally 30 days before your current insurance runs out, to check that you are getting the best deal. Don’t choose insurance based on price alone though – check that you are getting the cover that you require and check the customer satisfaction ratings for the insurance company that you are considering taking cover with.

Make a note in your phone, diary, calendar for when each insurance is due and set aside time to compare insurances in plenty of time.

5 Be interested in interest!

If you don’t understand interest rates, then take the time to read this information. Understanding interest, and keeping an eye on the rates, is vital to ensuring that you are making the most of your money.

Check the interest rate that you are getting on any savings – could you be getting a better rate?

Make a note of the interest rate that you are being charged on any debts that you have. Then check to see if you can get a cheaper rate by shifting these debts to another provider.

If you are worried about debt then you may like to check out Payplan. Based In Grantham, UK PayPlan.com offer free financial solutions to members of the British public needing help financially, for more information on their free debt management services visit their website.

And Finally

Once you have checked through all these areas, you should be able to make some reductions on your spending plan. This will give you more money available at the end of the month.

It is important to spend less than you earn, or you will get into a spiral of debt that can be really difficult to get out of. If you are still spending more than you earn, look through each area of expense with a fine-tooth comb and work out how to save money.

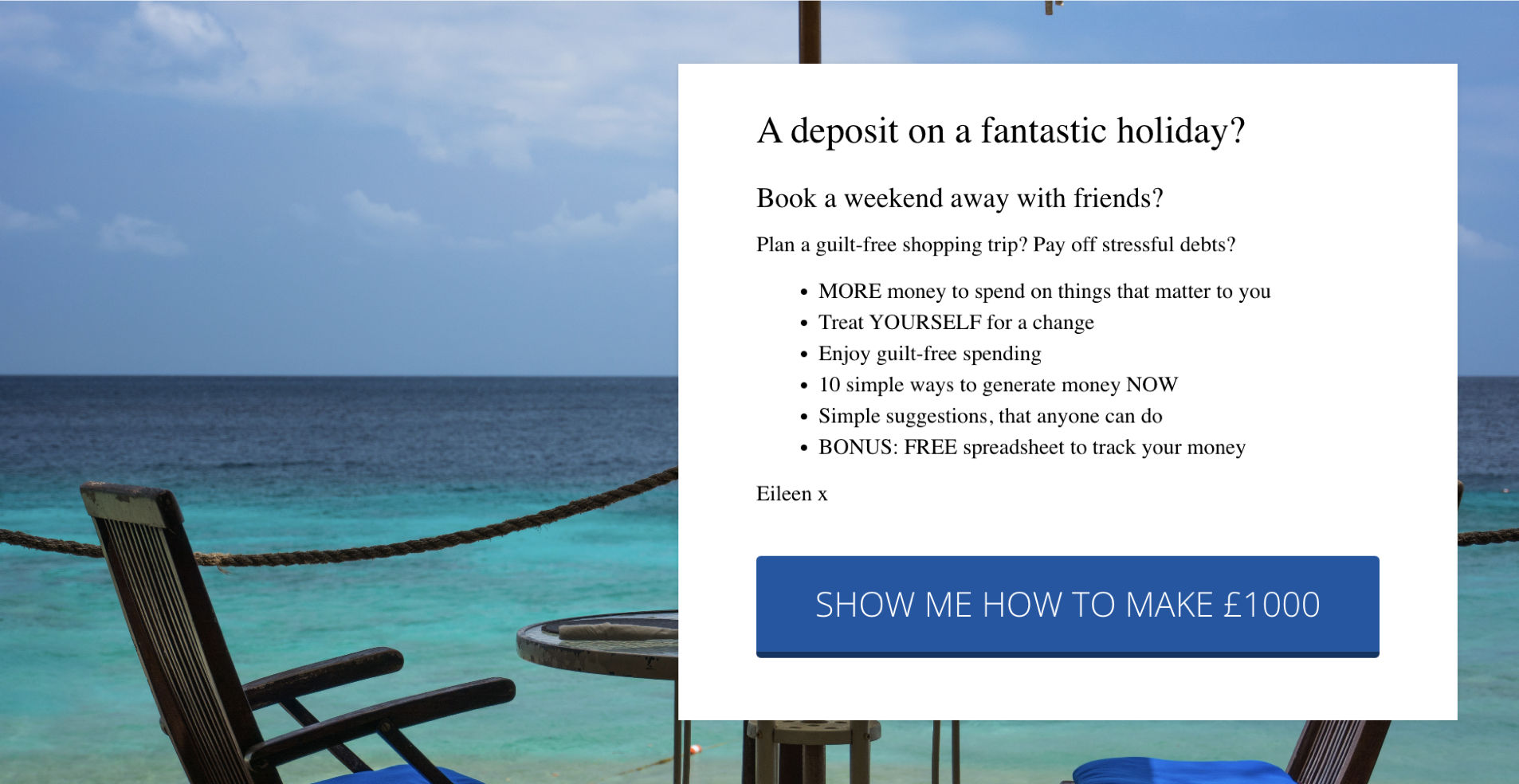

What about increasing your income? Would £1000 help you?

If you would like to look at ways of increasing your income to get your new budget off to a great start then download my 10 top tips to raise £1000 quickly.

If you do have debts, you may find that this post has some useful suggestions for paying this off.

To keep up with my hints and tips please like my Facebook page and/or join my Facebook group.

Eileen x

I am Eileen Adamson, Your Money, Sorted coach, working online with UK based women. I can help you to develop a better relationship with money and feel calm, relaxed and positive about money, allowing you to live the life that YOU want to lead.